IRS 1040 - Schedule EIC 2025-2026 free printable template

Instructions and Help about IRS 1040 - Schedule EIC

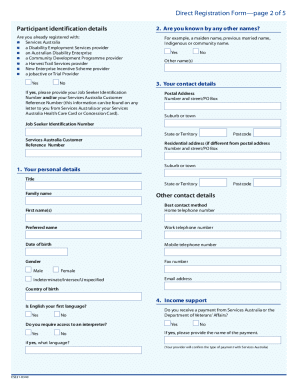

How to edit IRS 1040 - Schedule EIC

How to fill out IRS 1040 - Schedule EIC

Latest updates to IRS 1040 - Schedule EIC

All You Need to Know About IRS 1040 - Schedule EIC

What is IRS 1040 - Schedule EIC?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

Where do I send the form?

What is the purpose of this form?

Who needs the form?

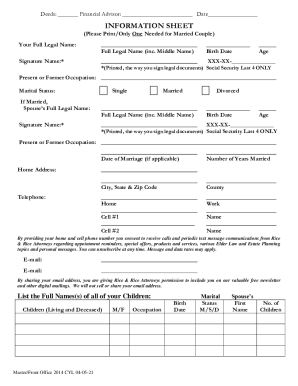

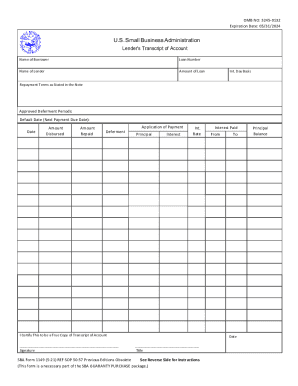

Components of the form

What information do you need when you file the form?

FAQ about IRS 1040 - Schedule EIC

What should I do if I realize I've made a mistake on my IRS 1040 - Schedule EIC after submission?

If you've made a mistake on your IRS 1040 - Schedule EIC after submission, you should file an amended return using Form 1040-X. This process allows you to correct any errors and ensure your filing reflects accurate information. Keep in mind that you should include any necessary documentation related to the correction.

How can I verify if my IRS 1040 - Schedule EIC has been received and processed?

You can check the status of your IRS 1040 - Schedule EIC by using the IRS 'Where's My Refund?' tool on their website, which provides updates on processing. If you e-filed, note that it usually processes faster than paper submissions, but be prepared for potential delays during peak tax season.

What types of common errors should I avoid to ensure my IRS 1040 - Schedule EIC is processed without issues?

Common errors on the IRS 1040 - Schedule EIC include incorrect Social Security numbers and failing to sign the return when required. Additionally, omitting income or credits that you qualify for can cause processing delays or issues with your refund.

Are there specific privacy and data security measures I should be aware of when filing my IRS 1040 - Schedule EIC online?

When filing your IRS 1040 - Schedule EIC online, ensure that you are using secure and reputable tax software that complies with IRS security standards. Keep personal information, like your Social Security number, private, and consider using e-signatures that meet IRS requirements for added data security.

See what our users say